We see opportunities others don’t — and invest like others can’t

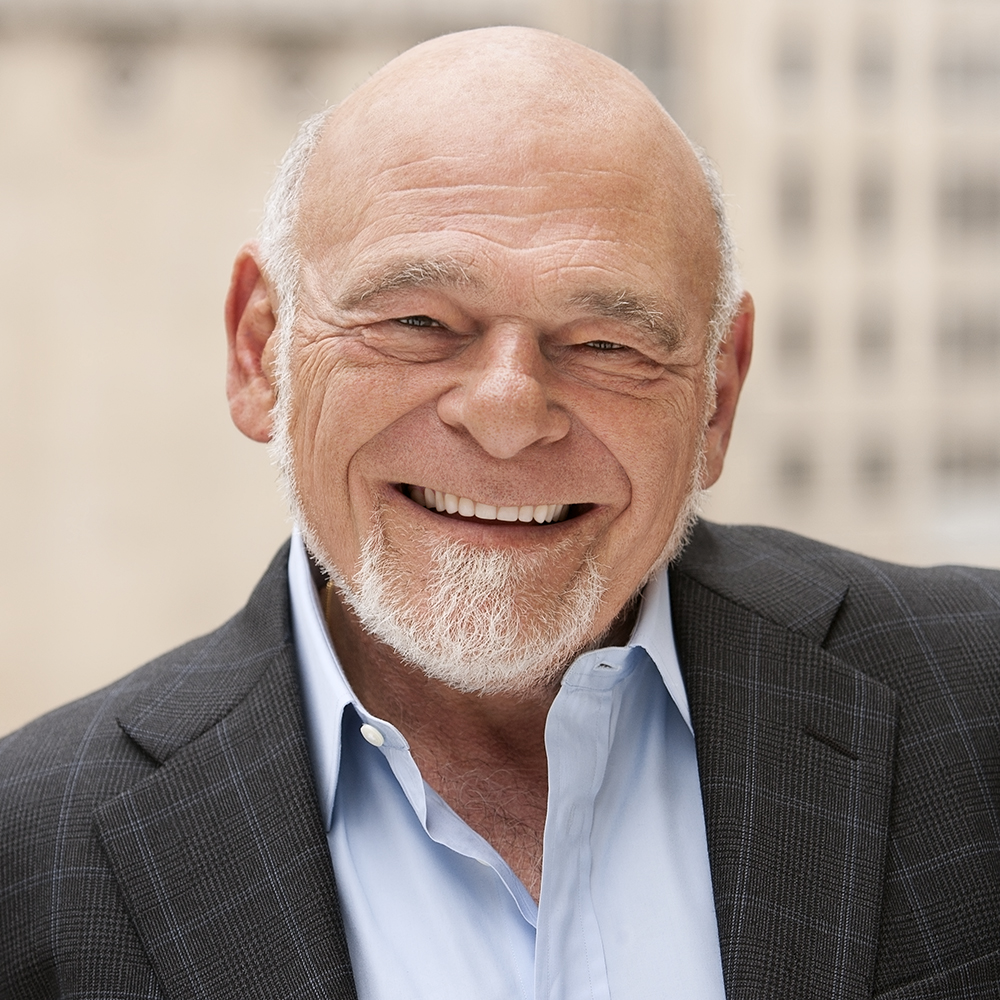

Founded by Sam Zell. Backed by his capital. Based on his principles.

Conventional wisdom is nothing but a reference point

We lean toward investments others have bypassed, often due to situational complexity. We deploy our in-house resources and leverage our considerable network to develop creative solutions – from financial restructurings to operational turnarounds. Our deep respect of risk and dedication to understanding the downside enable us to take on assets others won’t.

APPROACH & INVESTING WITH US

"When everyone isgoing left, look right."

A true partner shares the risk

Every one of our senior investment professionals commits his/her own capital to every deal we do. We have skin in the game. So, we are highly engaged owners. We get involved, working alongside portfolio company management often two to three levels deep within a company to maximize opportunity, potential and performance. As a partner, we operate on the basis of transparency, alignment and trust.

TeamA macro view advances opportunity

We are industry agnostic. Our investment portfolio ranges across sectors and geographies. We look for patterns, anomalies and disruptions in areas like demographics, supply and demand, and changing legislation to identify opportunities — for new investments and for our portfolio companies. This macro view aligns with our penchant for long-term investments; we are drawn to products and services that will be in demand for decades.

PortfolioEGI news

Much of our investment activity in private companies goes under the radar, but here’s what we can share:

About EGI